Updated on September 23, 2024

Short-term rental (STR) regulations and taxes are trending across the country, but as the November elections approach, California has emerged as a hotbed of ballot activity.

From a citizen initiative in the coastal city of Dana Point that would restrict STR activity to government-proposed increases in transient occupancy taxes (TOT) across California, these ballot measures reflect increased scrutiny and regulation of short-term rentals.

Higher transient occupancy taxes lead to a higher cost of doing business for STR operators and higher prices for guests who budgetary restrictions might deter. However, the focus on these taxes also offers a bright side: More government officials see the value of short-term rentals as a contributor to their revenue growth and the community’s economic growth, as you’ll see in arguments for and against the measures.

Dana Point, Orange County

Voters in Dana Point, a city of 32,500 in Orange County, will consider a ballot measure to cut the number of short-term rental permits in half. The city currently has 174 STR permits, according to the Orange County Register.

Political action committee Residents Who Care About Dana Point petitioned to place the measure on the ballot. The initiative would repeal the city’s existing STR ordinance and replace it as part of an effort to thwart plans by the city administration to expand the number of STR permits, according to the Orange County Register.

The measure requires annual renewal of STR permits and prioritizes permits for homestays and primary residences. Remaining permits for other kinds of STR properties would be allocated through a lottery system.

Responsibility for paying the transient occupancy tax (TOT) would shift to listing platforms like Airbnb and Vrbo. The platforms also would be required to display the city-issued permit number on listings.

If approved by voters, the initiative would need approval by the California Coastal Commission to become effective.

The mayor said the city’s 2023 short-term rental ordinance contains strict rules to eliminate nuisances. “One measure of its success is the lack of complaints from neighbors,” he wrote.

“In the first half of 2024, the city received six complaints related to STRs,” he reported. “After investigation, two were validated: one for noise and one for trash cans.”

Last year, short-term rentals generated $725,000 annually from the TOT, Mayor Jamey Federico said in an argument against the measure. Properties can be audited at any time to ensure they are paying the tax. Dana Point would lose at least $450,000 in annual revenue if the ballot measure passes.

The proposed ordinance also would have other negative consequences.

“The proposed annual permit lottery will create uncertainty for owners and may make them less committed to being good operators,” the mayor wrote. “The March 15-May 1 timing of the lottery is likely to eliminate advanced bookings and the repeat guests who are least likely to cause problems.”

“This will likely encourage unpermitted and unregulated operators,” he concluded.

Del Mar, San Diego County

Voters in Del Mar, a beach town near San Diego, will consider Measure M, allowing the city to collect a 13% transient occupancy tax from guests of all short-term rentals (those with stays of less than 30 days).

The city already collects the TOT from guests at hotels, motels, and certain other lodging providers.

Measure M does not require California Coastal Commission (CCC) approval and would take effect Jan. 1, 2025, if voters approve it, said Sarah Krietor, Del Mar Administrative Services Manager.

Hotels have paid the TOT since 1964. The city estimates extending the TOT to short-term rental properties would raise an additional $775,000 per year. The tax revenue is used for public safety, emergency services, street, park, and trail maintenance, libraries, and recreation.

Measure M also allows booking sites like Airbnb and Vrbo to collect the TOT, whereas currently, lodging providers have to remit the tax, according to the city attorney’s impartial analysis.

No argument in opposition to the measure had been filed as of Sept. 13.

Related: The City Council will also consider the adoption of proposed STR regulations on Sept. 23, 2024, that would cap the number of STRs to 129 units, approximately 5% of the housing stock, according to a city staff report. There are currently 123 STRs in Del Mar, and all of those would be allowed to continue operations. If the adopted by the City Council, the ordinance will require CCC approval to take effect, Sarah said.

Menlo Park, San Mateo County

Voters in Menlo Park, a city of 32,000 people in San Mateo County, Calif., will consider a measure to raise the city’s transient occupancy tax (TOT) from 12% to 15.5% over a two-year period. This tax applies to guests staying for 30 days or less in short-term rentals, hotels, and motels.

The TOT increase would generate an additional $3.6 million each year. The additional funds would help maintain city services, including road maintenance, 911 response, emergency preparedness, park programs, and other uses, according to The Almanac.

The City Council placed the measure on the ballot to address the city’s ongoing funding challenges, including a budget deficit for the 2024-25 year, The Almanac reported.

No one has filed an argument against the measure with the county registrar of elections.

Rancho Cucamonga, San Bernardino County

Voters in Rancho Cucamonga, a city of more than 176,300 in San Bernardino County, will consider a ballot measure that increases the transient occupancy tax on guests of hotels and short-term rentals from 10% to 12%. The increase would raise about $1 million in general fund revenue per year, according to an impartial analysis. The proceeds would go toward public safety, homelessness programs, infrastructure improvements, park maintenance, and programs for seniors and youth, according to the statement. No statement of opposition has been filed with the county elections office.

San Bernardino County

Voters in San Bernardino County, Calif., will consider Measure K, hiking the TOT from 7% to 11% on vacation rentals and hotels in unincorporated parts of the county. The county Board of Supervisors initiated the proposed increase because the county currently has one of the lowest TOT rates in the region and is missing out on potential revenue, Chief Executive Officer Luke Snoke reported.

Raising the rate to 11% would yield about $9.4 million in general fund revenue per year and go toward city services such as road maintenance, park upkeep, and other county services.

The rate has not been increased since 2022, according to a statement of support from county officials.

No argument against the measure was filed with the Registrar of Voters.

Santa Barbara County

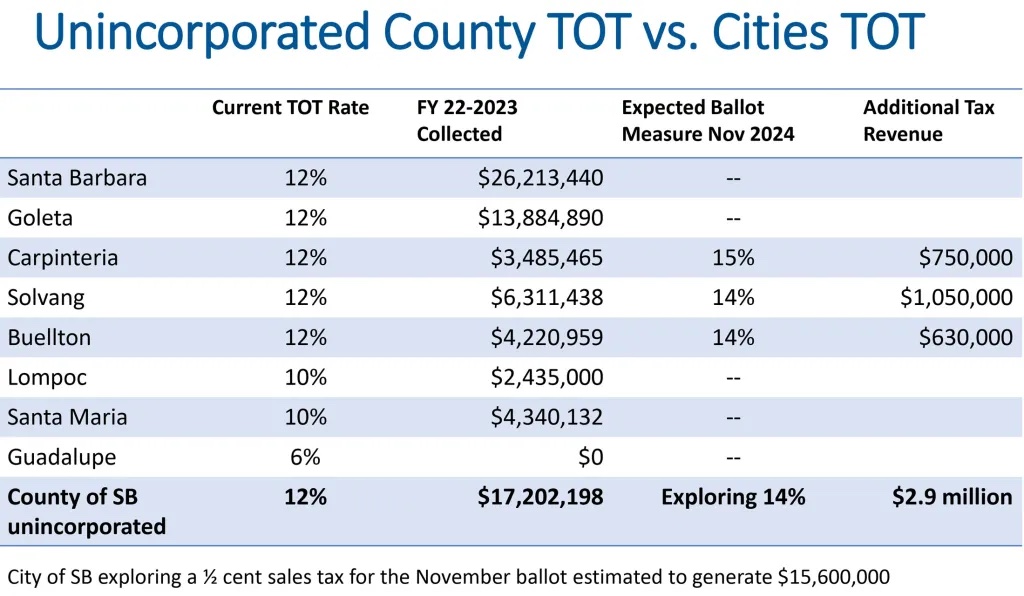

Santa Barbara County voters will decide on Nov. 5 whether to raise the transient occupancy tax by 2% on hotel stays and short-term rentals in unincorporated parts of the county (areas outside city limits).

Under the measure, the tax rate would increase from 12% to 14%, according to a county press release published in The Independent.

“The budget outlook in upcoming fiscal years shows a deficit, which will make it increasingly difficult to fund local priorities that improve the quality of life in our county,” County Executive Officer Mona Miyasato was quoted as saying in the press release. “If voters pass this measure, it would generate additional, locally controlled ongoing revenue.”

The tax would generate approximately $3 million annually and fund county services such as 911 communications, gang prevention, road and infrastructure maintenance and repair, groundwater protection, homelessness programs, and other county purposes.

The county currently collects the tax from 24 hotels and motels and 520 short-term rentals in unincorporated areas.

Opponents of the measure, which include destination marketing organizations and the hotel industry, said the increase could exacerbate the county’s 30% vacancy rate, saying the rate would be the highest on California’s Central Coast, Noozhawk reported.

The news outlet reported that Santa Barbara Supervisor Joan Hartmann said many STR operators are not collecting or reporting TOT to the county, and the city and county plan to bolster enforcement efforts.

…