Updated on April 2, 2025

If you own a short-term rental, you may have noticed an alarming trend: STR insurance coverage is harder to get, more expensive, or disappearing altogether. From California to Florida and everywhere in between, homeowners are receiving policy nonrenewal notices just as natural disasters become more frequent and more devastating.

These nonrenewal notices affect both standard homeowners insurance policies and STR-specific insurance policies. Homeowners insurance is designed for the personal use of a home, whereas STR insurance is tailored for properties rented out temporarily (typically less than 30 days) and protects you from guest liability, property damage caused by guests, theft, and loss of rental income due to covered events.

Read more: Do you need short-term rental insurance?

In California alone, more than 100,000 homeowners lost insurance coverage between 2019 and 2024, the San Francisco Chronicle reported. Following back-to-back wildfire seasons, major carriers like State Farm and Allstate drastically reduced their offerings. State Farm alone dropped 70% of its customers in areas like Pacific Palisades, where annual premiums now run as high as $7,500.

About 30 insurance companies abandoned the Florida market after Hurricane Ian caused widespread devastation in 2022, according to CNET.

Even Proper Insurance – one of the few carriers built for short-term rentals – has started pulling back.

“In some areas in the West and certain areas in the Appalachia, we have strict underwriting around forest fires, which may limit the availability of coverage,” said Nick Massey, Chief Sales Officer at Proper Insurance. “Underwriting for Proper specifically is on an address-by-address basis. The only way to know if we can or cannot write a policy is to review each individual address.”

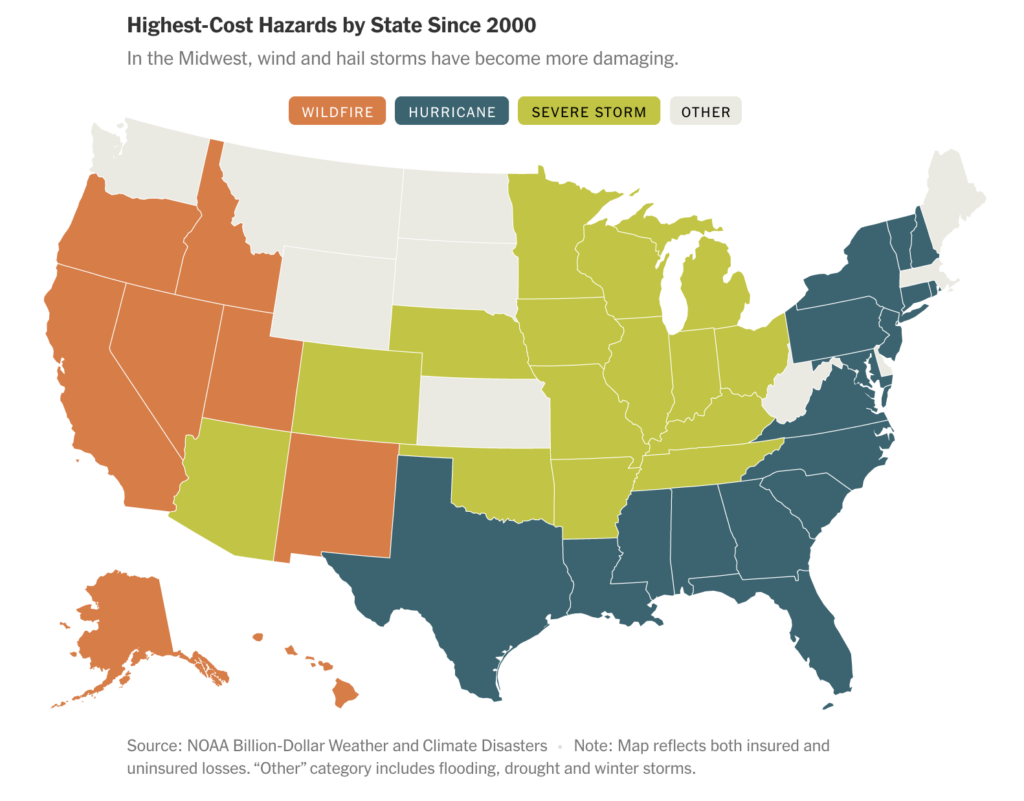

This challenge isn’t unique to notoriously high-risk areas like California, Florida, and Louisiana. Providing insurance has become unprofitable and is becoming increasingly unavailable in at least 15 other states, according to an analysis by the New York Times.

So what can you do if your insurer pulls out of your area or quotes you a policy that swallows your profits? Here are some ideas from the experts on how to get coverage and how to reduce your chances of being next on the policy nonrenewal list.

Do upgrades to reduce your risk

While natural disasters are becoming more challenging to predict, you can reduce your risks with some home upgrades. First, consider the most likely hazards in your region, whether wildfires, hurricanes, flooding, or earthquakes. Then, beef up your home’s defenses accordingly. For example, consider investing in ember-resistant vents, fire-retardant landscaping, reinforced roofing, or flood barriers.

These upgrades will help protect your property and reduce your insurance risk profile, and now or in the future, underwriters may require them to be willing to offer coverage. Find other ideas on how to prepare your home for natural disasters on the Insurance Institute for Business & Home Safety’s website, which offers Home Disaster Ready Guides for different kinds of natural disasters.

Explore specialized and secondary policies

If traditional homeowners insurance isn’t available, you may need to layer different policies with multiple insurers. Specialty carriers and surplus line insurers might be willing to cover your property, even if better-known companies won’t.

Another option may be a state-sponsored insurance plan, often known as Fair Access to Insurance Requirements, or FAIR. According to CNET, these policies offer coverage for risks that private insurers are unwilling to cover.

Check the Insurance Information Institute’s list of State FAIR Plan administrators.

You can check with your state’s Department of Insurance to explore which insurers are still available in your area.

“Shop around with as many insurance providers as possible,” Nick advised. “You may also have to piece together coverage. One company may cover the property but not liability, while another might do the reverse.”

While Proper Insurance is one of the few comprehensive STR providers, coverage isn’t guaranteed, especially in wildfire-prone areas like Big Bear or Lake Arrowhead, California. Expect premiums to be high and underwriting to be strict.

Work with a broker who knows high-risk STRs

Insurance brokers who specialize in short-term rentals or high-risk geographies can often find options you won’t uncover on your own, CNET noted. They’re also better equipped to understand the nuances of your business – like loss of rental income or guest liability – and may be able to combine policies creatively.

Consider a higher deductible

One way to offset rising premiums or increase your chances of getting coverage is by accepting a higher deductible. The trade-off may make sense if your primary concern is catastrophic coverage – not small claims. Before deciding, consider whether your rainy day fund would be enough to cover out-of-pocket expenses if needed.

Read more: Guide to emergency preparedness for vacation rentals

Buy in a Lower-Risk Area

As tempting as it may be to invest in a stunning property that fetches a high average daily rate in a high-demand market if that home sits in a disaster-prone area, you could be putting your investment at serious risk. Insurance instability isn’t just a temporary headache—it can become a long-term liability that’s hard to recover from.

If you purchase a property that later becomes uninsurable due to wildfire, flood, or hurricane risk, you may be unable to sell it because lenders typically require active insurance to approve a mortgage, Nick said.

Before you buy, research the insurance market in the area. Look into recent claims history, natural disaster frequency, and whether insurers are pulling out or raising rates dramatically. That picture will tell you more about the sustainability of your investment than any booking forecast alone. In today’s climate, buying in a lower-risk region could protect your investment.

…